What Is Fractional Shares Trading?

Are you interested in investing in the stock market but don't have the funds to buy whole shares of expensive stocks? Fractional shares trading might be the solution you're looking for. This innovative investment method allows you to own a fraction of a share, making it accessible to investors with limited capital. In this blog article, we will delve into the details of fractional shares trading, exploring what it is, how it works, and the benefits it offers.

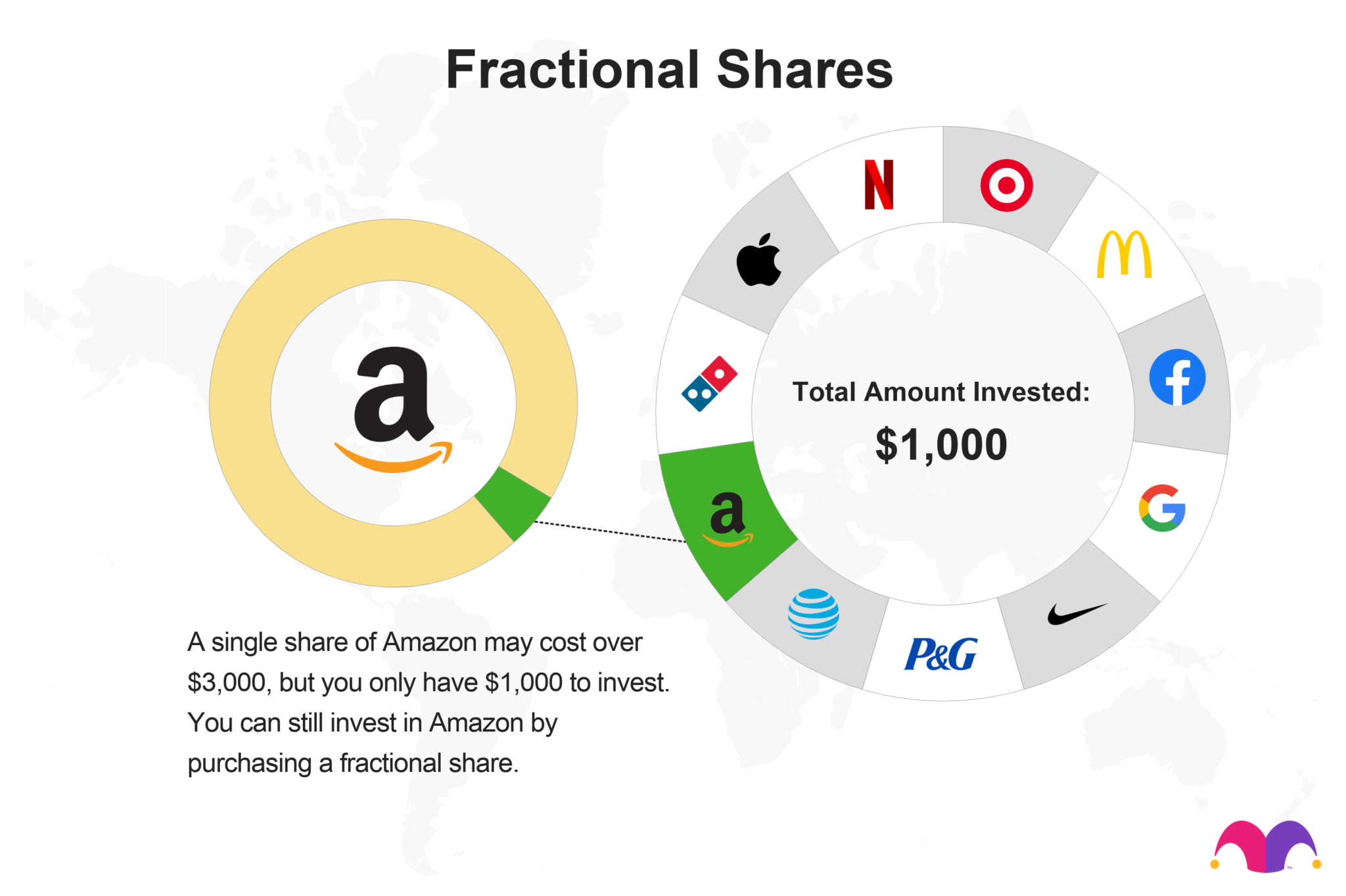

First and foremost, let's define what exactly fractional shares trading means. In traditional stock trading, investors purchase whole shares of a company's stock, which can be costly for high-priced stocks like Amazon or Google. Fractional shares trading, on the other hand, allows investors to buy and own a fraction of a share, meaning they can invest in companies that have high share prices without needing to spend a significant amount of money.

The Basics of Fractional Shares Trading

In this section, we will cover the fundamental aspects of fractional shares trading. We'll explain how fractional shares are created, how investors can buy and sell them, and the platforms that facilitate this type of trading. Understanding the basics will lay the foundation for a deeper comprehension of how fractional shares trading works.

Creating Fractional Shares

Fractional shares are created by brokerage platforms that enable fractional shares trading. These platforms pool together whole shares of stocks and divide them into smaller fractions, which are then allocated to individual investors. This process allows investors to purchase and own a fraction of a share, even if the price of a whole share is beyond their budget. The creation of fractional shares has opened up investment opportunities to a wider range of individuals who may have previously been unable to invest in high-priced stocks.

Buying and Selling Fractional Shares

To buy fractional shares, investors need to open an account with a brokerage platform that offers fractional shares trading. Once the account is set up, investors can search for the stocks they're interested in and specify the dollar amount they want to invest. The brokerage platform will then allocate the corresponding fraction of a share to the investor. Selling fractional shares follows a similar process, where investors can choose to sell their fractional shares for a specific dollar amount. The brokerage platform will execute the sale and credit the investor's account accordingly.

Platforms for Fractional Shares Trading

Several brokerage platforms have emerged to facilitate fractional shares trading. Some popular platforms include Robinhood, Fidelity, and Charles Schwab. These platforms provide user-friendly interfaces and intuitive trading functionalities, making it easy for investors to navigate fractional shares trading. Each platform may have its own fees, features, and limitations, so it's important for investors to compare and choose a platform that aligns with their investment goals and preferences.

Benefits of Fractional Shares Trading

Why should investors consider fractional shares trading? This section will explore the various advantages that come with this investment method. From diversification opportunities to the ability to invest in high-priced stocks, we'll highlight the key benefits that make fractional shares trading an attractive option for many investors.

Diversification

Fractional shares trading allows investors to diversify their portfolios more easily. Instead of having to put all their capital into a single stock, investors can spread their investment across multiple stocks, even if they have limited funds. This diversification helps mitigate risk by reducing the impact of any one stock's performance on the overall portfolio. With fractional shares trading, investors can have a more balanced and diversified investment strategy, potentially leading to more stable long-term returns.

Access to High-Priced Stocks

High-priced stocks like Amazon or Google have traditionally been out of reach for many investors due to their high share prices. Fractional shares trading changes that by allowing investors to own a fraction of these expensive stocks. For example, if the price of one share of Amazon is $3,000, an investor with only $100 can still own a fraction of that share. This gives investors access to companies and industries that they may believe in but were previously unable to invest in due to financial constraints.

Affordability

Fractional shares trading makes investing more affordable for individuals with limited capital. Instead of having to save up a large sum of money to buy whole shares, investors can start with smaller amounts and gradually build their investments over time. This affordability aspect of fractional shares trading lowers the barrier to entry for new investors and allows them to participate in the stock market without needing substantial upfront funds.

Risks and Limitations of Fractional Shares Trading

While fractional shares trading offers numerous advantages, it's essential to be aware of the potential risks and limitations. In this section, we will discuss the downsides of fractional shares trading, such as limited voting rights, potential liquidity issues, and the impact of stock splits and dividends.

Limited Voting Rights

One of the limitations of fractional shares trading is that investors may have limited voting rights. When owning fractional shares, investors may not have the same voting power as those who own whole shares. This is because voting rights are often tied to whole shares, and fractional shareholders may not have the ability to cast votes on company matters. While this may not be a concern for all investors, it is important to understand that fractional shares trading may limit participation in certain corporate decisions.

Liquidity Concerns

Fractional shares are not as liquid as whole shares, meaning they may not be as easily bought or sold. While major brokerage platforms that offer fractional shares trading provide liquidity for these investments, there may be instances where fractional shares are less liquid compared to whole shares. This could potentially impact the ability to sell fractional shares quickly, especially during volatile market conditions. Investors should consider this liquidity aspect and be prepared for potential delays in executing trades involving fractional shares.

Stock Splits and Dividends

Stock splits and dividends can also pose challenges for fractional shares trading. When a company announces a stock split, the number of shares held by investors may increase, but the value of each share decreases. This can complicate the fractional shares trading process, as the brokerage platform needs to adjust the fractions held by each investor accordingly. Similarly, when a company pays out dividends, the amount received by fractional shareholders may be relatively small compared to whole shareholders. These factors should be taken into account when considering the impact of stock splits and dividends on fractional shares trading.

How to Get Started with Fractional Shares Trading

Ready to dip your toes into fractional shares trading? This section will guide you through the process of getting started. From choosing a brokerage platform to opening an account and making your first fractional share investment, we'll provide step-by-step instructions to help beginners navigate this investment approach.

Selecting a Brokerage Platform

The first step in getting started with fractional shares trading is selecting a brokerage platform that offers this service. Consider factors such as fees, user interface, customer support, and the range of available stocks when choosing a platform. Popular brokerage platforms that offer fractional shares trading include Robinhood, Fidelity, and Charles Schwab, among others.

Opening an Account

Once you've chosen a brokerage platform, you'll need to open an account. This typically involves providing personal information, such as your name, address, and social security number. Some platforms may require additional documentation for verification purposes. It's important to ensure that the brokerage platform you choose is reputable and has proper security measures in place to protect your personal and financial information.

Funding Your Account

After opening an account, you'll need to fund it to start investing in fractional shares. Most brokerage platforms offer various funding options, including bank transfers, wire transfers, and linking a debit or credit card. Choose the option that works best for you and follow the platform's instructions to transfer funds into your account. Ensure that you have sufficient funds to cover any initial investments or trading fees that may apply.

Researching and Choosing Stocks

With a funded account, it's time to research and choose the stocks you want to invest in. Conduct thorough research on the companies you're interested in, considering factors such as their financial performance, industry trends, and future growth prospects. Many brokerage platforms provide research tools and educational resources to assist investors in making informed decisions. Take advantage of these resources to select stocks that align with your investment goals and risk tolerance.

Making Your First Investment

Once you've chosen the stocks you want to invest in, it's time to make your first fractional share investment. On the brokerage platform, search for the desired stock and specify the dollar amount you want to invest. The platform will calculate and allocate the corresponding fraction of a share to your account. Double-check the details before confirming your investment to ensure accuracy. Congratulations, you've made your first fractional share investment!

Popular Platforms for Fractional Shares Trading

With the increasing popularity of fractional shares trading, several brokerage platforms have emerged to meet the demand. In this section, we will introduce some of the most popular platforms that offer fractional shares trading services. We'll explore their features, fees, and any unique benefits they provide to investors.

Robinhood

Robinhood is a well-known brokerage platform that pioneered commission-free trading. They offer fractional shares trading, allowing investors to buy and sell fractions of shares with ease. Robinhood provides a user-friendly interface and a wide range of stocksto choose from. They also offer educational resources and tools to help investors make informed decisions. One of the key advantages of Robinhood is its commission-free model, which means investors can trade fractional shares without incurring additional fees. However, it's important to note that Robinhood has faced some criticism regarding its customer support and limitations in trading features. Nonetheless, Robinhood remains a popular choice for investors looking to engage in fractional shares trading.

Fidelity

Fidelity is a well-established brokerage platform that offers a comprehensive range of investment services, including fractional shares trading. With Fidelity, investors can buy and sell fractions of shares in popular companies. The platform provides a robust research and analysis toolkit, allowing investors to make informed decisions. Fidelity is known for its excellent customer service and strong reputation in the industry. While Fidelity does charge trading fees, they have recently introduced commission-free trading for certain stocks and ETFs, making fractional shares trading more accessible for investors.

Charles Schwab

Charles Schwab is another reputable brokerage platform that offers fractional shares trading. With a wide selection of stocks to choose from, investors can easily build a diversified portfolio of fractional shares. Charles Schwab provides a user-friendly platform and offers a range of research and analysis tools to support investors in their decision-making process. While Charles Schwab does charge trading fees, they have also introduced commission-free trading for select stocks and ETFs. Additionally, Charles Schwab has a strong reputation for its customer service and investor education resources.

Strategies for Fractional Shares Trading

Now that you understand the basics and have access to fractional shares trading, it's essential to develop a solid investment strategy. In this section, we will discuss various strategies that investors can employ when trading fractional shares, such as dollar-cost averaging, sector-focused investing, and diversification techniques.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money into a particular stock or portfolio at regular intervals, regardless of share price fluctuations. With fractional shares trading, investors can easily implement this strategy by consistently investing a fixed dollar amount into their chosen stocks. This approach helps mitigate the impact of market volatility by buying more shares when prices are low and fewer shares when prices are high. Over time, this strategy can potentially result in a lower average cost per share and reduce the impact of short-term market fluctuations on the overall investment.

Sector-Focused Investing

Another strategy for fractional shares trading is sector-focused investing. Instead of trying to build a diversified portfolio across various industries, investors can concentrate their investments in specific sectors or industries they believe will perform well. Fractional shares trading allows investors to allocate smaller amounts of capital to multiple companies within a particular sector, enabling them to gain exposure to the overall performance of that sector. This strategy can be beneficial for investors who have a strong understanding of specific industries or who want to capitalize on emerging trends within those sectors.

Diversification Techniques

Diversification is a key principle in investing, and fractional shares trading makes it easier for investors to diversify their portfolios. Investors can allocate their capital across various stocks and sectors, reducing the risk associated with relying heavily on a single company or industry. Fractional shares trading allows investors to own fractions of multiple high-priced stocks, providing a more balanced and diversified portfolio. It's important for investors to research and select a mix of stocks from different industries to achieve effective diversification.

Tax Implications of Fractional Shares Trading

Investors must also be aware of the tax implications associated with fractional shares trading. This section will provide an overview of the tax considerations, including capital gains and losses, dividends, and reporting requirements. Understanding the tax implications will ensure investors can navigate this investment method in a financially responsible manner.

Capital Gains and Losses

When selling fractional shares, investors may realize capital gains or losses, depending on the difference between the purchase price and the sale price. If the sale price is higher than the purchase price, it results in a capital gain, which is taxable. Conversely, if the sale price is lower than the purchase price, it results in a capital loss, which may be used to offset other capital gains or reduce taxable income. It's important for investors to keep track of their transactions and consult with a tax professional to understand the specific rules and regulations regarding capital gains and losses in their jurisdiction.

Dividends

Different companies pay dividends to their shareholders, which may also apply to fractional shares. When a company pays out a dividend, fractional shareholders are typically entitled to receive a proportional amount based on their ownership. These dividend payments are generally taxable income and should be reported on the investor's tax return. It's crucial for investors to keep track of dividend payments received from fractional shares and report them accurately to comply with tax regulations.

Reporting Requirements

Investors engaging in fractional shares trading should be aware of the reporting requirements for their transactions. They may need to report their purchases, sales, capital gains, and dividends on their tax returns. The specific reporting requirements can vary depending on the investor's jurisdiction and tax laws. It's advisable for investors to maintain accurate records of their transactions and consult with a tax professional to ensure compliance with reporting requirements and maximize any potential tax benefits or deductions.

Fractional Shares Trading vs. Traditional Stock Trading

In this section, we will compare fractional shares trading to traditional stock trading. By examining the differences between these two methods, individuals can make an informed decision about which approach aligns best with their investment goals and preferences.

Accessibility

One of the significant advantages of fractional shares trading is its accessibility. Traditional stock trading typically requires investors to purchase whole shares, which can be costly for high-priced stocks. Fractional shares trading, on the other hand, allows investors to own fractions of shares, making it more affordable and accessible, particularly for individuals with limited capital.

Diversification

Fractional shares trading provides an opportunity for investors to diversify their portfolios more easily compared to traditional stock trading. With fractional shares, investors can allocate smaller amounts of capital across multiple stocks and industries, reducing the risk associated with relying heavily on a single company or industry. Traditional stock trading may require larger capital investments to achieve the same level of diversification.

Liquidity

Traditional stock trading generally offers higher liquidity compared to fractional shares trading. Whole shares are typically more liquid, meaning they can be bought or sold more easily and quickly. Fractional shares may have limitations in terms of liquidity, especially during volatile market conditions. Investors should consider their liquidity needs and trading preferences when deciding between fractional shares trading and traditional stock trading.

Voting Rights

When it comes to voting rights, traditional stock trading provides more robust participation compared to fractional shares trading. In traditional stock trading, each whole share typically carries one vote at shareholders' meetings, allowing investors to have a more significant influence on corporate decisions. Fractional shareholders may have limited or no voting rights, as voting rights are often tied to whole shares. Investors who value voting rights and active participation in corporate matters may prefer traditional stock trading.

Frequently Asked Questions about Fractional Shares Trading

To address any lingering queries, this section will provide answers to frequently asked questions about fractional shares trading. From minimum investment amounts to the impact on voting rights, we'll aim to cover a range of common concerns and provide clarity for readers.

1. What is the minimum amount required to invest in fractional shares?

The minimum investment amount for fractional shares can vary depending on the brokerage platform. Some platforms may have no minimum investment requirement, allowing investors to start with as little as $1. It's essential to research the specific platform's requirements before getting started with fractional shares trading.

2. How are fractional shares priced?

Fractional shares are typically priced proportionally to the value of a whole share. For example, if one share of a company is priced at $100, and you own a fraction equal to 0.5 shares, then your fractional share would be valued at $50. The pricing of fractional shares follows the same market movements as whole shares.

3. Can I sell fractional shares at any time?

While fractional shares can generally be sold at any time, the liquidity of fractional shares may vary depending on market conditions and the specific brokerage platform. Investors should be aware that there may be limitations or delays in executing trades involving fractional shares, particularly during volatile market periods.

4. Do fractional shareholders receive dividends?

Yes, fractional shareholders are entitled to receive dividends from the companies they hold fractional shares in. The dividend payments are typically proportional to the ownership percentage of the fractional shares. However, the amount received as dividends from fractional shares may be relatively small compared to whole shareholders.

5. Are fractional shares eligible for stock splits?

Yes, fractional shares can be affected by stock splits. When a company announces a stock split, the number of shares held by investors may increase, but the value of each share decreases. This can complicate the fractional shares trading process, as the brokerage platform needs to adjust the fractions held by each investor accordingly.

The Future of Fractional Shares Trading

As fractional shares trading continues to gain traction, it's essential to explore its future potential. In this final section, we will discuss the outlook for fractional shares trading, including potential advancements,industry trends, and emerging technologies that may shape its future.

Increased Accessibility

One of the key trends in the future of fractional shares trading is increased accessibility. As more brokerage platforms offer fractional shares trading and competition in the market intensifies, we can expect to see lower minimum investment requirements and reduced fees. This will further democratize investing and attract more individuals to participate in the stock market, regardless of their financial means.

Expanding Range of Stocks

Currently, the range of stocks available for fractional shares trading is continuously expanding. As more companies and industries recognize the demand for fractional shares trading, they may choose to make their stocks available in fractional form. This expansion will provide investors with a broader pool of investment opportunities, including access to previously unattainable stocks.

Integration of Fractional Shares in Retirement Accounts

Another potential development in fractional shares trading is the integration of fractional shares within retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k)s. This could allow individuals to invest in fractional shares as part of their retirement savings strategy, further diversifying their portfolios and potentially increasing long-term returns. This integration would provide individuals with additional flexibility and options for retirement planning.

Advancements in Technology

Advancements in technology will likely play a significant role in the future of fractional shares trading. As brokerage platforms continue to enhance their trading systems and user interfaces, investors can expect more streamlined and user-friendly experiences. Furthermore, emerging technologies such as blockchain and tokenization may introduce new possibilities for fractional ownership and trading, potentially revolutionizing the way fractional shares are created, traded, and managed.

In conclusion,

fractional shares trading offers a unique and accessible way for investors to participate in the stock market, even with limited funds. By allowing individuals to own a fraction of a share, this investment method opens doors to high-priced stocks and diversification opportunities. However, it's crucial to understand the risks and limitations associated with fractional shares trading and develop a well-thought-out investment strategy. As this investment approach gains popularity, it's important to stay informed about the latest platforms, tax implications, and industry trends to make the most of fractional shares trading.