What Trading Platforms Offer Fractional Shares: A Comprehensive Guide

Are you interested in investing in the stock market but don't have a large amount of capital to start with? Fractional shares may be the solution you've been looking for. In this blog article, we will explore what trading platforms offer fractional shares, allowing you to invest in your favorite companies with even a small amount of money. Whether you're a beginner or an experienced investor, this comprehensive guide will provide you with all the information you need to get started.

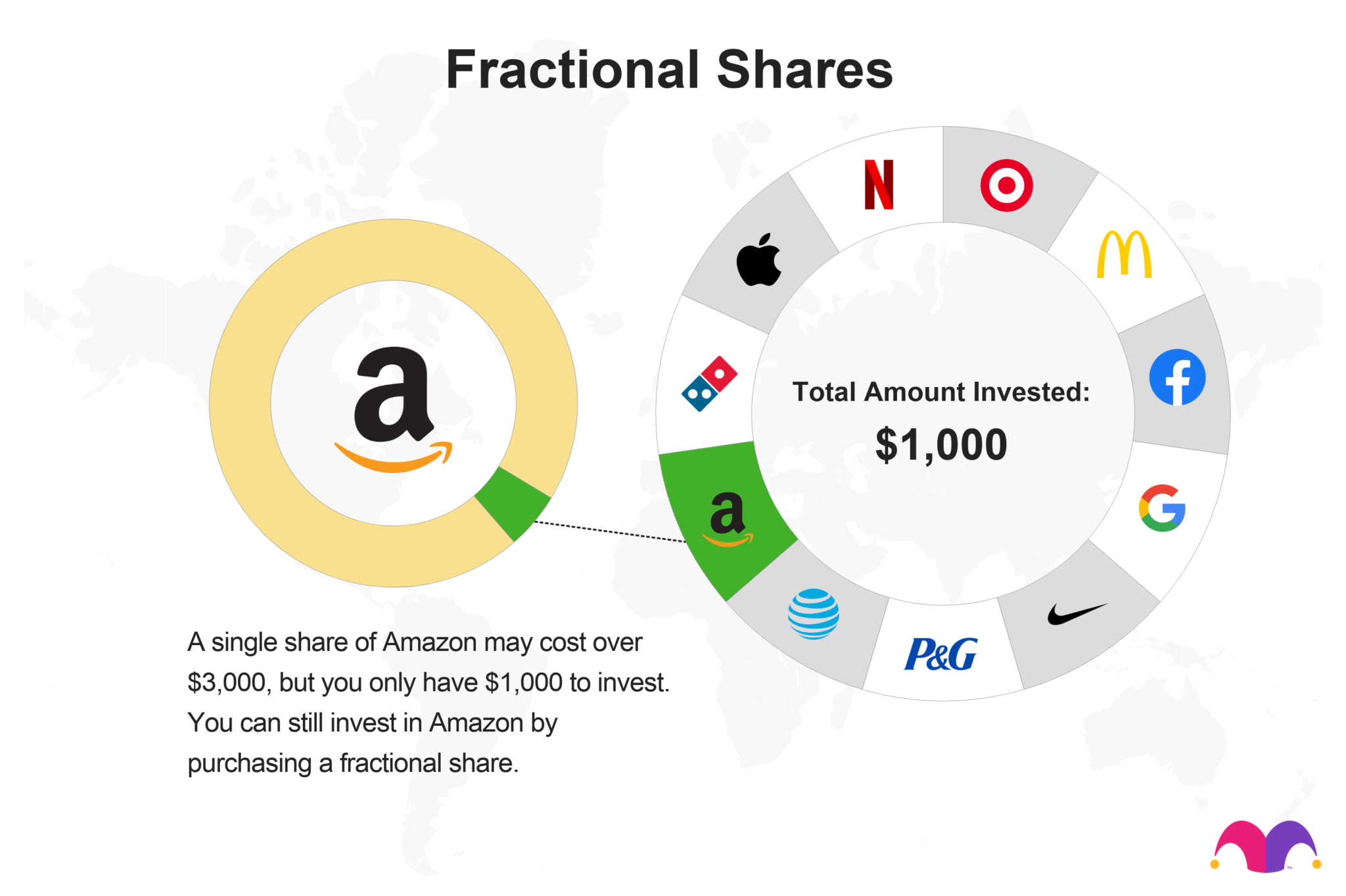

Before we dive into the specific trading platforms that offer fractional shares, let's first understand what fractional shares are. In simple terms, fractional shares allow investors to own a portion of a company's stock rather than a whole share. This is particularly beneficial for those who want to invest in high-priced stocks such as Amazon or Google but don't have the funds to purchase a full share. Fractional shares make it possible for anyone to invest in these companies and potentially benefit from their growth.

Platform A: Offering Fractional Shares

Features and Benefits

Platform A is one of the leading trading platforms that offer fractional shares. With a user-friendly interface and a wide range of investment options, it is a popular choice among investors. The platform provides a hassle-free experience for beginners and experienced investors alike. One of the key features of Platform A is the low minimum investment amount, allowing investors to start with as little as $1. This makes it accessible to individuals with limited funds who still want to participate in the stock market.

Platform A also offers a transparent fee structure, providing investors with clarity on the costs associated with their investments. The platform charges a small percentage-based fee on the invested amount, ensuring that investors are aware of the charges upfront. This transparency is crucial for investors to make informed decisions and manage their investment costs effectively.

Available Stocks

Platform A offers a wide range of stocks that can be purchased as fractional shares. From popular tech giants to well-established companies across various industries, investors have a plethora of options to choose from. The platform provides access to a comprehensive list of stocks, ensuring that investors can diversify their portfolios and invest in companies that align with their investment goals and interests.

Summary: Platform A is a user-friendly trading platform that allows investors to purchase fractional shares of various stocks. It offers a low minimum investment amount and transparent fee structure, providing a hassle-free experience for investors. With a comprehensive list of available stocks, investors can diversify their portfolios and align their investments with their goals and interests.

Platform B: The Fractional Shares Pioneer

Robust Trading Tools

Platform B is renowned for being one of the first trading platforms to introduce fractional shares. It has gained a reputation for its robust trading tools, making it an excellent choice for investors who want to take a more active approach to their investments. The platform provides advanced charting tools, real-time market data, and customizable indicators, empowering investors to analyze market trends and make informed decisions.

Additionally, Platform B offers comprehensive research resources, including analyst reports and company news, to help investors stay informed about the stocks they own or are interested in. These tools and resources provide investors with the necessary insights to make well-informed investment decisions.

Educational Resources

Platform B also stands out for its dedication to educating investors. The platform provides a wide range of educational resources, including articles, videos, and webinars, to help investors enhance their knowledge and skills. Whether you're a beginner or an experienced investor, Platform B ensures that you have access to the educational tools needed to navigate the stock market successfully.

Summary: Platform B is a pioneer in offering fractional shares and provides a range of trading tools and educational resources. With robust trading tools and comprehensive research resources, investors can analyze market trends and make informed decisions. The platform's dedication to education ensures that investors have the necessary knowledge and skills to navigate the stock market effectively.

Platform C: Fractional Shares for International Stocks

Global Opportunities

If you're interested in investing in international stocks, Platform C is the trading platform for you. It opens up a world of investment opportunities by allowing investors to purchase fractional shares of companies listed on international stock exchanges. This feature enables investors to diversify their portfolios and potentially benefit from the growth of international markets.

Platform C provides access to stocks from various countries, including emerging markets, giving investors exposure to different economies and industries. By investing in international fractional shares, investors can take advantage of global trends and potentially achieve higher returns.

Research and Analysis

Platform C understands the importance of research and analysis when it comes to investing in international stocks. The platform offers comprehensive research tools and analysis resources specific to international markets. Investors can access country-specific reports, economic data, and expert insights, helping them make informed decisions about their international investments.

Summary: Platform C allows investors to purchase fractional shares of international stocks, opening up a world of investment opportunities. With access to stocks from various countries and comprehensive research tools, investors can diversify their portfolios and make informed decisions based on global trends and analysis.

Platform D: Social Trading and Fractional Shares

Following Successful Traders

Platform D combines the power of social trading with fractional shares, creating a unique investment experience. Investors can follow and copy the trades of successful traders, even when investing with fractional shares. This feature allows novice investors to learn from experienced traders and potentially replicate their success.

By following successful traders, investors can gain insights into their trading strategies and decision-making processes. This social aspect of investing provides a valuable learning opportunity for individuals who want to improve their investment skills.

Community Interaction

Platform D also fosters a sense of community among its users. Investors can interact with each other, share ideas, and discuss investment strategies. This community aspect of the platform creates a supportive environment where investors can learn from one another and gain different perspectives on the market.

Summary: Platform D offers a social trading experience alongside fractional shares, allowing investors to follow and copy the trades of successful traders. The platform's community interaction features create a supportive environment where investors can learn from each other and gain valuable insights into investment strategies.

Platform E: Fractional Shares and Automated Investing

Algorithmic Portfolios

Platform E takes a different approach by offering automated investing with fractional shares. The platform uses algorithms to create personalized investment portfolios based on the investor's goals, risk tolerance, and time horizon. This feature eliminates the need for manual portfolio management and provides a hands-off investment experience.

Investors can input their investment preferences, and the platform will generate optimized portfolios that align with their goals. The automated nature of Platform E ensures that portfolios are regularly rebalanced to maintain the desired asset allocation and adapt to market conditions.

Customization and Control

Despite the automated approach, Platform E allows investors to customize their portfolios based on their preferences. Investors can choose specific sectors, industries, or investment themes they want to focus on. This level of customization provides investors with control over their investments while still benefiting from the convenience of automated investing.

Summary: Platform E combines fractional shares with automated investing, offering personalized investment portfolios based on algorithms. The platform's automated approach eliminates the need for manual portfolio management, providing investors with a convenient and hands-off investment experience. Investors also have the option to customize their portfolios based on their preferences.

Platform F: Fractional Shares for ETFs

Benefits of ETFs

ETFs (Exchange-Traded Funds) are popular investment vehicles due to their diversification benefits and ease of trading. Platform F specializes in fractional shares for ETFs, providing investors with a convenient way to diversify their portfolios and gain exposure to a wide range of assets.

Investing in ETFs allows investors to access a basket of stocks or other assets with a single investment. This diversification helps mitigate risks and provides exposure to different market segments or sectors. Fractional shares for ETFs make it possible for investors to invest in these funds with even a small amount of capital.

Range of ETF Options

Platform F offers a comprehensive selection of ETFs for investors to choose from. Whether you're interested in broad market index ETFs or specialized sector-focused ETFs, the platform provides access to a wide range of options. This variety allows investors to tailor their portfolios to their investment preferences and goals.

Summary: Platform F specializes in fractional shares for ETFs, providing investors with a convenient way to diversify their portfolios. Investing in ETFs offers diversification benefits and ease of trading. With a broad range of ETF options available, investors can align their investments with their preferences and goals.

Platform G: Fractional Shares and Dividend Reinvestment

Maximizing Dividend Returns

Dividend reinvestment is a powerful strategy for long-term investors, and Platform G offers the ability to reinvest dividends into fractional shares. This feature allows investors to maximize their dividend returns by automatically reinvesting the dividends received back into the company's stock.

By reinvesting dividends into fractional shares, investors can benefit from the compounding effect over time. This strategy can significantly enhance long-term returns and help investors build wealth through regular dividend payments and capital appreciation.Automatic Reinvestment

Platform G simplifies the dividend reinvestment process by automatically reinvesting dividends into fractional shares. Once an investor opts for dividend reinvestment, the platform will allocate the dividends to purchase additional fractional shares of the respective company's stock. This automation eliminates the need for manual reinvestment and ensures a seamless and efficient process for investors.

Long-Term Growth Potential

Dividend reinvestment combined with fractional shares can have a significant impact on long-term wealth accumulation. By consistently reinvesting dividends, investors can acquire more shares of a company's stock over time. As the number of shares increases, so does the potential for future dividend payments and capital appreciation. This strategy is particularly advantageous for investors with a long-term investment horizon, as it allows for compounding growth over many years.

Summary: Platform G allows investors to reinvest dividends into fractional shares, maximizing the potential for long-term growth. The platform automates the process, simplifying dividend reinvestment. By consistently reinvesting dividends, investors can benefit from the compounding effect and enhance their long-term returns.

Platform H: Fractional Shares for Retirement Accounts

Retirement Account Compatibility

Retirement accounts are a crucial component of an individual's financial planning, and Platform H offers fractional shares within these accounts. Whether it's a traditional IRA, Roth IRA, or 401(k), investors can utilize fractional shares to build their retirement portfolios. This compatibility ensures that investors can leverage the benefits of fractional shares while saving for their future.

Tax-Advantaged Growth

Investing in fractional shares within a retirement account offers tax advantages that can enhance long-term growth. Traditional IRAs and 401(k)s provide tax-deferred growth, allowing investments to grow without being subject to annual capital gains taxes. Roth IRAs offer tax-free growth, meaning that any gains made on investments, including fractional shares, can be withdrawn tax-free in retirement.

Diversification and Risk Management

By including fractional shares in retirement portfolios, investors can diversify their holdings and manage risk effectively. The ability to invest in a wide range of companies and industries through fractional shares allows for portfolio diversification, which can reduce the impact of individual stock volatility. Diversification is particularly important in retirement accounts, as it helps protect savings and provides a more stable foundation for long-term wealth accumulation.

Summary: Platform H provides fractional shares for retirement accounts, allowing investors to grow their retirement savings with a diversified portfolio. Investing in fractional shares within retirement accounts offers tax advantages and enables effective risk management through diversification.

Platform I: Educational Resources for Fractional Share Investors

Comprehensive Learning Materials

Investing in fractional shares may be new to some investors, and Platform I offers a range of educational resources to support them. The platform provides comprehensive learning materials such as articles, tutorials, and interactive courses to help investors understand the concept of fractional shares, their benefits, and how to effectively invest in them.

Investment Strategies and Insights

Platform I goes beyond the basics and offers in-depth investment strategies and insights specifically tailored for fractional share investors. These resources cover topics such as portfolio diversification, risk management, and long-term wealth accumulation. Investors can access expert advice and learn from real-life case studies to enhance their investment knowledge and decision-making skills.

Community Forums and Webinars

Platform I fosters a sense of community among fractional share investors by providing forums and webinars where investors can interact, ask questions, and share experiences. These platforms allow investors to learn from their peers, gain different perspectives, and stay updated on the latest trends and developments in the world of fractional share investing.

Summary: Platform I offers a range of educational resources to guide investors in their journey of investing in fractional shares. From comprehensive learning materials to investment strategies and insights, investors can enhance their knowledge and decision-making skills. The platform's community forums and webinars provide a platform for interaction and learning from other fractional share investors.

Platform J: Fractional Shares and Risk Management

Risk Assessment Tools

Platform J takes risk management seriously by providing investors with tools to assess and manage their risk exposure. The platform offers risk assessment tools that help investors determine their risk tolerance and create investment strategies that align with their risk preferences. By understanding their risk tolerance, investors can make informed decisions and ensure that their investment portfolios are in line with their risk appetite.

Portfolio Diversification

Platform J emphasizes the importance of portfolio diversification as a risk management strategy. Through fractional shares, investors can easily diversify their portfolios across different companies, sectors, and asset classes. Diversification helps spread risk and reduces the impact of any single investment on the overall portfolio. Platform J provides tools and resources to assist investors in building well-diversified portfolios that can withstand market fluctuations.

Stop-Loss Orders and Risk Alerts

To further enhance risk management, Platform J offers features like stop-loss orders and risk alerts. Stop-loss orders allow investors to set specific price thresholds at which their fractional share holdings will be automatically sold to limit potential losses. Risk alerts notify investors of significant market movements or changes in their portfolio's risk profile, enabling them to make timely adjustments or reassess their investment strategies.

Summary: Platform J combines fractional shares with risk management tools, allowing investors to control their risk exposure. The platform provides risk assessment tools, emphasizes portfolio diversification, and offers features like stop-loss orders and risk alerts to help investors effectively manage their investments.

In conclusion, investing in fractional shares has never been more accessible, thanks to the various trading platforms that offer this feature. Whether you're a beginner investor with limited funds or an experienced investor looking for diversification options, there is a trading platform that suits your needs. By exploring the platforms mentioned in this comprehensive guide, you can make an informed decision and embark on your journey of investing in fractional shares.