Sofi Extended Hours Trading: Everything You Need to Know

Are you looking to maximize your trading opportunities and make the most of the stock market? If so, understanding extended hours trading is essential. One platform that offers extended hours trading is SoFi, a popular online brokerage platform known for its user-friendly interface and innovative features. In this blog article, we will dive into the world of SoFi extended hours trading, exploring what it is, how it works, and why it might be beneficial for you.

Before we delve into the specifics of SoFi extended hours trading, let's first understand the concept of extended hours trading in general. Traditional stock market trading hours typically run from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday. However, extended hours trading allows investors to buy and sell stocks outside of these regular trading hours. This extended trading window can provide both opportunities and risks, making it an enticing option for many traders.

What is SoFi Extended Hours Trading?

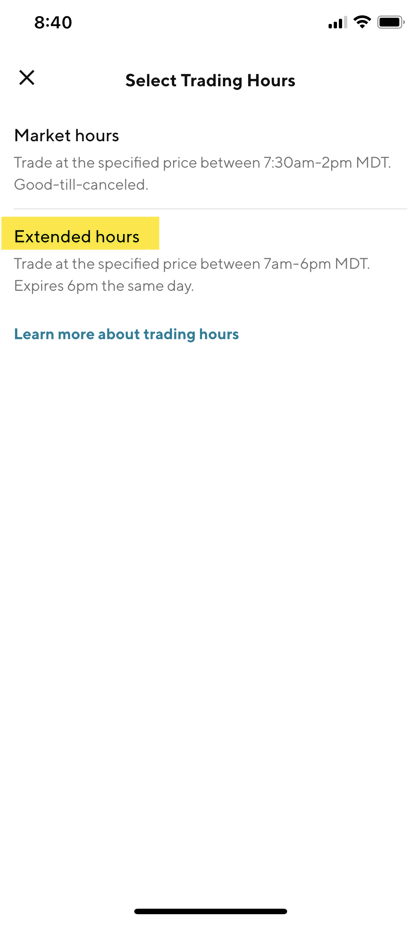

SoFi extended hours trading refers to the ability of SoFi users to trade stocks before the opening and after the closing of regular market hours. This feature allows investors to react to news and events that occur outside of regular trading hours, potentially giving them an edge in the market. SoFi offers two extended hours trading sessions: pre-market and after-hours.

Pre-Market Trading on SoFi

Pre-market trading on SoFi begins at 4:00 AM Eastern Time and continues until the market opens at 9:30 AM. During this session, investors can place orders to buy or sell stocks before the market officially opens. Pre-market trading can be particularly advantageous for those seeking to react to overnight news or earnings announcements. However, it's important to note that pre-market trading tends to have lower liquidity and higher volatility compared to regular market hours.

After-Hours Trading on SoFi

After-hours trading on SoFi begins immediately after the market closes at 4:00 PM and continues until 8:00 PM Eastern Time. During this session, investors can place orders to buy or sell stocks even after the regular market hours have ended. After-hours trading is particularly attractive for traders who want to react to post-market earnings releases or other after-market news. However, it's crucial to be aware that after-hours trading can also experience lower liquidity and increased volatility.

SoFi extended hours trading offers several benefits for traders looking to take advantage of additional trading opportunities. Firstly, it allows investors to react promptly to breaking news or events that occur outside of regular market hours. This can be particularly advantageous for those who want to capitalize on earnings releases or economic reports that are announced before or after the market opens. Additionally, extended hours trading on SoFi can help traders with busy schedules to manage their investments effectively without interfering with their daily routine.

Risks and Considerations

While SoFi extended hours trading presents exciting opportunities, it's crucial to be aware of the risks and considerations associated with trading during these extended sessions. Firstly, extended hours trading tends to have lower liquidity, meaning there may be fewer buyers and sellers in the market. This lower liquidity can lead to wider bid-ask spreads and potential price slippage. Additionally, increased volatility during extended trading hours can amplify the risk of wild price swings and unexpected movements. It's essential for traders to carefully consider their risk tolerance and adapt their strategies accordingly.

Managing Liquidity Risks

One of the main risks of extended hours trading is lower liquidity, which can impact the execution of trades. With fewer participants in the market, there may be less buying and selling activity, resulting in wider bid-ask spreads. This can make it more challenging to obtain favorable prices for trades. To manage liquidity risks, it's important for traders to use limit orders rather than market orders. Limit orders allow traders to specify the maximum price they are willing to pay for a stock or the minimum price at which they are willing to sell. By setting these limits, traders can have more control over the price at which their trades execute.

Dealing with Increased Volatility

Extended hours trading is known for its increased volatility compared to regular trading hours. Price swings can be more significant, and unexpected news or events can have a greater impact on stock prices. Traders must be prepared for these potential fluctuations and adjust their strategies accordingly. It's essential to conduct thorough research, stay updated on relevant news, and have a clear plan in place. Setting stop-loss orders can also help mitigate risk by automatically triggering a sale if a stock reaches a predetermined price, limiting potential losses.

Accessing SoFi extended hours trading is simple and convenient. All you need is a SoFi Invest account, which you can easily create through their website or mobile app. Once you have an account, you'll have the option to participate in pre-market and after-hours trading. It's important to note that not all stocks are available for extended hours trading, so be sure to check the specific stock's availability before placing an order.

Tips for Successful SoFi Extended Hours Trading

When engaging in SoFi extended hours trading, it's beneficial to keep a few tips in mind. Firstly, make sure to stay informed about the latest news and events that may impact the market outside of regular trading hours. This will help you make more informed trading decisions. Additionally, consider using limit orders instead of market orders to have more control over the price at which your trade executes. Lastly, be mindful of the potential risks associated with extended hours trading and adjust your trading strategies accordingly.

Stay Informed

Successful extended hours trading requires staying informed about news and events that can influence the market. This includes monitoring overnight developments, earnings releases, economic reports, and geopolitical events. Having access to reliable news sources and market analysis tools can help you make more informed trading decisions during extended hours.

Use Limit Orders

Limit orders provide greater control over trade execution during extended hours trading. Instead of placing a market order, which executes at the best available price, consider setting a limit order with a specific price at which you are willing to buy or sell. This way, you can avoid potential unfavorable prices due to increased volatility or wider bid-ask spreads.

Adapt Your Strategies

Extended hours trading requires adapting your strategies to the unique characteristics of this trading window. Consider adjusting your risk management techniques, such as setting tighter stop-loss orders or reducing position sizes to account for increased volatility. Additionally, be mindful of trading psychology and avoid impulsive decisions based on short-term price fluctuations.

SoFi does not charge any additional fees for extended hours trading. The trading fees remain the same as regular market hours, making it a cost-effective option for traders looking to expand their trading window. However, it's important to note that other fees, such as regulatory fees or margin interest, may still apply.

Alternatives to SoFi Extended Hours Trading

If SoFi extended hours trading does not meet your specific needs, several other brokerage platforms also offer extended trading hours. Some popular alternatives include TD Ameritrade, E*TRADE, and Charles Schwab. Each platform may have its own unique features and fee structures, so it's important to compare and choose the one that best aligns with your trading goals.

TD Ameritrade

TD Ameritrade is a well-known brokerage platform that offers extended hours trading. With TD Ameritrade's thinkorswim platform, traders have access to pre-market and after-hours trading sessions. The platform provides a wide range of tools and resources to help traders analyze the market and make informed decisions during extended hours.

E*TRADE

E*TRADE also offers extended hours trading, allowing investors to trade before the market opens and after it closes. E*TRADE's Power E*TRADE platform provides access to pre-market and after-hours trading, along with a suite of research and analysis tools to support traders during extended hours.

Charles Schwab

Charles Schwab offers extended hours trading through its StreetSmart Edge platform. Traders can participate in pre-market and after-hours trading sessions, taking advantage of additional trading opportunities. The platform also offers advanced charting tools and real-time market data to assist traders in making informed decisions.

In conclusion, SoFi extended hours trading is a valuable tool for traders looking to expand their trading opportunities. It allows investors to react to news and events outside of regular market hours, providing them with a competitive edge. Whether you're a seasoned trader or just starting, SoFi extended hours trading can be a valuable addition to your trading arsenal. By understanding the ins and outs of SoFi extended hours trading, you can enhance your trading experience and potentially boost your investment returns.