Merrill Lynch Trading Fees: Everything You Need to Know

Are you considering trading with Merrill Lynch but uncertain about their trading fees? Look no further! In this comprehensive blog article, we will delve into the details of Merrill Lynch trading fees, providing you with all the information you need to make an informed decision. Whether you are a beginner investor or an experienced trader, understanding these fees is crucial to managing your investment portfolio effectively.

Before we dive into the specifics, it's important to note that Merrill Lynch offers a wide range of investment services, including brokerage accounts, retirement accounts, and managed portfolios. As a result, the trading fees can vary depending on the type of account and the specific investment products you choose. Now, let's explore the various trading fees you may encounter with Merrill Lynch.

Account Opening and Maintenance Fees

When you decide to open an account with Merrill Lynch, there are certain fees associated with account opening and maintenance that you should be aware of. These fees may vary depending on the type of account you choose, such as a standard brokerage account or a retirement account like an Individual Retirement Account (IRA).

Minimum Balance Requirements

One important aspect to consider is the minimum balance requirement for your account. Merrill Lynch may require you to maintain a certain minimum balance in your account to avoid incurring additional fees. The minimum balance requirement can differ depending on the type of account and the services you opt for. It's crucial to understand the specific requirements for your chosen account to avoid unnecessary charges.

Annual Account Fees

In addition to the minimum balance requirement, Merrill Lynch may charge an annual account fee. This fee is typically assessed annually and covers the cost of maintaining your account. The amount of this fee can vary based on factors such as the type of account, the services you utilize, and the total value of your account. Be sure to review the fee schedule provided by Merrill Lynch to understand the annual account fee applicable to your specific situation.

Inactivity Fees

Some Merrill Lynch accounts may also have inactivity fees. These fees are typically charged if your account remains inactive for a certain period of time. Inactivity fees are designed to encourage regular trading activity and engagement with your account. To avoid incurring these fees, it's important to review the account terms and conditions to understand the specific requirements and take appropriate action to maintain activity in your account.

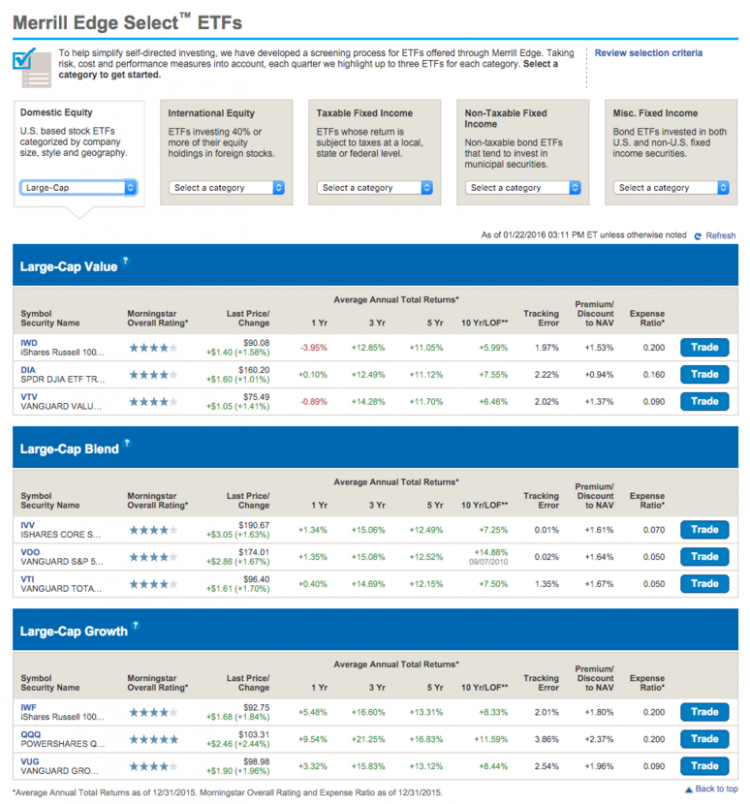

Stock and ETF Trading Fees

If you are interested in trading individual stocks or Exchange-Traded Funds (ETFs), Merrill Lynch charges specific fees for these transactions. Understanding these fees is essential when calculating the overall cost of your trades and evaluating potential investment opportunities.

Commission Fees

Commission fees are the most common type of trading fee charged by Merrill Lynch for stock and ETF transactions. These fees are typically based on a per-trade basis, meaning you will be charged a certain amount for each buy or sell transaction. The commission fee can vary depending on factors such as the type of account you have, the volume of your trades, and any promotions or discounts available at the time of the transaction.

Additional Charges

In addition to commission fees, Merrill Lynch may apply additional charges for stock and ETF trading. These charges can include regulatory fees, exchange fees, and transaction fees. Regulatory fees are imposed by regulatory bodies to fund their oversight and supervision activities. Exchange fees are charged by stock exchanges for executing trades on their platforms. Transaction fees may apply to certain types of trades or specific market conditions. It's important to review the fee schedule provided by Merrill Lynch to understand the potential additional charges related to your stock and ETF trading activities.

Options Trading Fees

If you are interested in trading options, Merrill Lynch offers a platform for options trading. However, it's important to understand the fees associated with options trading to make informed decisions and effectively manage your trading costs.

Contract Fees

Options trading involves the buying and selling of contracts, and Merrill Lynch charges fees for each contract traded. The contract fee can vary depending on factors such as the type of options contract, the number of contracts traded, and the current market conditions. It's essential to review the fee schedule provided by Merrill Lynch to understand the specific contract fees applicable to your options trading activities.

Exercise and Assignment Fees

When trading options, there may be situations where you choose to exercise or assign your options contracts. Merrill Lynch may charge fees for these actions. Exercising an options contract means you are choosing to exercise your right to buy or sell the underlying asset at the specified price. Assigning an options contract means you are transferring your rights and obligations to another party. It's important to understand the exercise and assignment fees charged by Merrill Lynch to assess the potential costs involved in these actions.

Other Potential Charges

Aside from contract fees and exercise/assignment fees, there may be other potential charges associated with options trading on Merrill Lynch's platform. These charges can include regulatory fees, exchange fees, and transaction fees similar to those encountered in stock and ETF trading. It's crucial to review the fee schedule provided by Merrill Lynch to gain a comprehensive understanding of all the potential charges involved in options trading.

Mutual Fund Trading Fees

Merrill Lynch offers a variety of mutual funds for investment, and understanding the fees associated with mutual fund trading is vital to making informed investment decisions.

Transaction Fees

When buying or selling mutual funds through Merrill Lynch, you may encounter transaction fees. These fees are typically charged for each buy or sell transaction and can vary depending on factors such as the type of mutual fund, the specific share class, and the total value of the transaction. It's important to review the fee schedule provided by Merrill Lynch to understand the transaction fees applicable to the mutual funds you intend to trade.

Load Fees

Some mutual funds may impose load fees, which are sales charges associated with buying or selling shares of the fund. Load fees can be categorized as front-end loads or back-end loads. Front-end loads are charged when purchasing shares, while back-end loads are charged when selling shares. The amount of the load fee can vary based on factors such as the specific mutual fund and the share class you choose. Be sure to review the prospectus or offering documents of the mutual fund to understand the load fees associated with your investment.

Expense Ratios

In addition to transaction fees and load fees, mutual funds also have expense ratios. The expense ratio represents the ongoing costs of managing and operating the mutual fund. It includes expenses such as management fees, administrative fees, and other operational costs. The expense ratio is presented as a percentage of the fund's average net assets and is deducted from the fund's returns. When considering investing in mutual funds, it's important to review the expense ratios to assess the impact on your overall investment returns.

Fixed Income Trading Fees

If you are interested in trading fixed income securities, such as bonds and Treasury bills, Merrill Lynch offers a platform for fixed income trading. However, there are specific fees associated with trading these types of securities that you should be aware of.

Transaction Fees

When buying or selling fixed income securities through Merrill Lynch, you may encounter transaction fees. These fees are typically charged for each buy or sell transaction and can vary depending on factors such as the type of fixed income security, the specific bond or Treasury bill, and the total value of the transaction. It's important to review the fee schedule provided by Merrill Lynch to understand the transaction fees applicable to the fixed income securities you intend to trade.

Markup/Markdown

In addition to transaction fees, Merrill Lynch may apply a markup or markdown to the price of fixed income securities. A markup is an additional amount added to the prevailing market price when buying a security, while a markdown is a reduction in the prevailing market price when selling a security. The markup or markdown represents the compensation received by Merrill Lynch for facilitating the transaction. It's important to be aware of these potential markups or markdowns when trading fixed income securities to accurately calculate the cost or proceeds of your trades.

Other Potential Charges

There may be other potential charges associated with fixed income trading on Merrill Lynch's platform. These charges can include regulatory fees, exchange fees, and transaction fees similar to those encountered in stock and ETF trading. It's important to review the fee schedule provided by Merrill Lynch to gain a comprehensive understanding of all the potential charges involved in fixed income trading.

Advisory and Managed Portfolio Fees

If you prefer a more hands-off approach and opt for Merrill Lynch's advisory or managed portfolio services, there are specific fees associated with these services. Understanding these fees is crucial to evaluating the cost-effectiveness of these offerings.

Asset-Based Fees

Merrill Lynch may charge asset-based fees for advisory and managed portfolio services. These fees are generally calculated as a percentage of the total assets under management. The percentage can vary depending on factors such as the level of service provided, the investment strategy employed, and the total value of your portfolio. Asset-based fees cover the cost of ongoing portfolio management, investment advice, and access to Merrill Lynch's research and resources. Be sure to review the fee schedule provided by Merrill Lynch to understand the asset-based fees applicable to your chosen advisory or managed portfolio service.

Performance-Based Fees

In addition to assetBased fees, Merrill Lynch may also offer performance-based fees for certain advisory or managed portfolio services. These fees are typically contingent on the performance of your portfolio, and they are calculated as a percentage of the investment gains or profits achieved. Performance-based fees incentivize the portfolio manager to generate positive returns for investors. However, it's important to carefully review the terms and conditions related to performance-based fees, as they can vary based on factors such as the specific investment strategy and the benchmark used for comparison.

Wrap Fees

Another fee structure that Merrill Lynch may offer for advisory and managed portfolio services is wrap fees. Wrap fees are comprehensive fees that cover all aspects of portfolio management, including investment advice, trading costs, and administrative expenses. Rather than charging separate fees for each service, a wrap fee consolidates these costs into a single fee. The wrap fee is typically calculated as a percentage of the total assets under management and can vary depending on the level of service and the complexity of your portfolio. It's important to review the fee schedule provided by Merrill Lynch to understand the wrap fees associated with your chosen advisory or managed portfolio service.

Margin Trading Fees

If you are interested in margin trading, Merrill Lynch offers margin accounts that allow you to borrow funds to leverage your trading activities. However, margin trading involves additional risks and fees that you should be aware of before engaging in this type of trading.

Interest Rates

When you borrow funds through a margin account, Merrill Lynch charges interest on the borrowed amount. The interest rate can vary depending on factors such as prevailing market rates, the amount borrowed, and the specific terms of your margin account. It's important to carefully review the interest rates charged by Merrill Lynch to assess the cost of borrowing and the potential impact on your trading profitability.

Margin Maintenance Requirements

Merrill Lynch imposes margin maintenance requirements to ensure that you have sufficient equity in your margin account to cover potential losses. If the value of your margin account falls below the minimum margin maintenance requirement, you may be required to deposit additional funds or sell securities to bring your account back into compliance. Failure to meet margin maintenance requirements can result in margin calls and potential liquidation of your positions. It's crucial to understand the specific margin maintenance requirements imposed by Merrill Lynch to effectively manage your margin trading activities.

Margin Call Fees

In the event of a margin call, Merrill Lynch may charge fees for executing the necessary trades to bring your account into compliance with margin maintenance requirements. These fees can include transaction fees, commission fees, and other charges associated with selling securities or depositing additional funds. It's important to be aware of the potential margin call fees when engaging in margin trading to accurately calculate the overall cost of your trades.

IRA and Retirement Account Fees

If you are considering opening an Individual Retirement Account (IRA) or other retirement account with Merrill Lynch, it's important to understand the specific fees associated with these accounts.

Account Opening and Maintenance Fees

When opening an IRA or retirement account with Merrill Lynch, there may be certain fees associated with account opening and maintenance. These fees can vary depending on the type of retirement account and the services you choose. It's essential to review the fee schedule provided by Merrill Lynch to understand the account opening and maintenance fees applicable to your chosen retirement account.

IRA Custodial Fees

In addition to account opening and maintenance fees, Merrill Lynch may charge custodial fees for IRAs. These fees cover the cost of administering and maintaining the IRA, including record-keeping, tax reporting, and compliance with IRS regulations. The custodial fee is typically calculated as a percentage of the total assets held within the IRA and may be assessed annually or quarterly. Be sure to review the fee schedule provided by Merrill Lynch to understand the custodial fees associated with your IRA.

Inactivity and Termination Fees

Merrill Lynch may impose inactivity fees if your account remains inactive for a certain period of time. Inactivity fees are designed to encourage regular trading activity and engagement with your account. These fees can vary depending on factors such as the type of account and the duration of inactivity. It's important to review the account terms and conditions to understand the specific requirements and potential inactivity fees associated with your account.

In the event that you decide to terminate or close your account with Merrill Lynch, there may be termination fees involved. These fees can cover the administrative costs of closing the account and processing any necessary paperwork. The termination fee, if applicable, can vary depending on factors such as the type of account and the specific circumstances of the account closure. It's important to review the account terms and conditions to understand the potential termination fees associated with closing your account.

Additional Fees and Considerations

In addition to the fees discussed above, there are other potential fees and considerations to keep in mind when trading with Merrill Lynch.

Foreign Transaction Fees

If you engage in international trading or hold foreign securities in your account, Merrill Lynch may charge foreign transaction fees. These fees are typically imposed on trades or transactions involving foreign currencies or securities and can vary depending on factors such as the specific currency or market involved. It's important to review the fee schedule provided by Merrill Lynch to understand the potential foreign transaction fees that may apply to your trading activities.

Wire Transfer Fees

If you need to transfer funds into or out of your Merrill Lynch account via wire transfer, there may be wire transfer fees involved. These fees can vary depending on factors such as the amount of the transfer, the destination or source of the funds, and any intermediary banks involved in the transfer. It's important to review the fee schedule provided by Merrill Lynch to understand the wire transfer fees applicable to your specific situation.

Tax Implications

It's crucial to consider the potential tax implications of your trading activities with Merrill Lynch. Depending on the type of account and the specific investments you hold, you may be subject to capital gains taxes, dividend taxes, or other tax obligations. It's highly recommended to consult with a tax advisor or professional to understand the tax implications of your trading activities and ensure compliance with relevant tax laws and regulations.

In conclusion, navigating the world of Merrill Lynch trading fees requires a comprehensive understanding of the different fees associated with various types of accounts and investment products. By familiarizing yourself with account opening and maintenance fees, stock and ETF trading fees, options trading fees, mutual fund trading fees, fixed income trading fees, advisory and managed portfolio fees, margin trading fees, IRA and retirement account fees, inactivity and termination fees, as well as additional fees and considerations, you can make well-informed decisions and effectively manage your investment portfolio. Remember to review the most up-to-date fee schedules provided by Merrill Lynch and consult with a financial advisor to tailor your investment strategy to your specific needs and goals.