Bank of America Stock Trading Account: A Comprehensive Guide

Are you interested in investing in the stock market? Bank of America offers a stock trading account that may be just what you're looking for. In this blog article, we will provide you with a detailed and comprehensive guide to Bank of America's stock trading account. Whether you're a beginner or an experienced investor, this article will equip you with the knowledge you need to make informed investment decisions.

Before we dive into the specifics of Bank of America's stock trading account, let's first understand the basics of stock trading. Stock trading involves buying and selling shares of publicly traded companies. It allows individuals to invest in the growth and success of these companies and potentially earn a profit. Bank of America's stock trading account provides a platform for individuals to engage in this exciting world of investing.

What is a stock trading account?

A stock trading account is a type of brokerage account that allows investors to buy and sell stocks and other securities. It serves as a bridge between the investor and the stock market, providing a platform to place trades and monitor investments. Bank of America's stock trading account offers a user-friendly interface and a range of features to help investors manage their portfolio effectively.

When you open a stock trading account with Bank of America, you gain access to a variety of investment options. You can trade stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. The account acts as a hub for all your investment activities, providing you with a consolidated view of your holdings and transactions.

One of the key advantages of having a stock trading account is the ability to trade in real-time. You can place trades instantly, taking advantage of market movements and seizing opportunities as they arise. With Bank of America's stock trading account, you can monitor the live market data, track stock prices, and execute trades with just a few clicks.

Features and benefits of Bank of America's stock trading account

Bank of America's stock trading account offers a wide range of features and benefits to its users. These include access to real-time market data, research tools, educational resources, and personalized support from experienced professionals.

Real-time market data: Bank of America provides users with up-to-date market information, including stock quotes, charts, and news. This enables investors to stay informed about the latest market trends and make timely investment decisions.

Research tools: Bank of America's stock trading account comes equipped with powerful research tools that can help you analyze stocks and make informed investment choices. These tools provide in-depth company profiles, financial data, analyst reports, and more. You can also access historical data and compare the performance of different stocks to identify potential investment opportunities.

Educational resources: Whether you're new to investing or an experienced trader, Bank of America offers a wealth of educational resources to enhance your knowledge and skills. These resources include articles, videos, webinars, and interactive tutorials that cover a wide range of investment topics. You can learn about fundamental and technical analysis, risk management strategies, and various investment approaches.

Personalized support: Bank of America understands that investing can be complex, especially for beginners. That's why they provide personalized support from experienced professionals. You can reach out to their team of financial advisors who can offer guidance, answer your questions, and provide tailored investment recommendations based on your goals and risk tolerance.

Opening a stock trading account with Bank of America

Interested in opening a stock trading account with Bank of America? Here's a step-by-step guide to help you get started:

Gather the required documents

Before you begin the account opening process, make sure you have the necessary documents at hand. These typically include your identification documents (such as a passport or driver's license), proof of address (such as a utility bill or bank statement), and your Social Security number or taxpayer identification number.

Complete the application

Once you have the required documents, you can begin the application process. Bank of America provides an online application form that you can fill out at your convenience. The form will ask for personal information, financial details, and investment preferences. Make sure to provide accurate information to ensure a smooth account opening process.

Read and agree to the terms and conditions

Before submitting your application, it's important to read and understand the terms and conditions of the stock trading account. This document outlines the rights and responsibilities of both the investor and the brokerage firm. Take the time to review this information carefully and ensure that you agree to the terms before proceeding.

Fund your account

Once your application is approved, you'll need to fund your stock trading account to start investing. Bank of America provides various funding options, including electronic fund transfers, wire transfers, and check deposits. Choose the method that works best for you and follow the instructions provided by the bank.

Summary: Opening a stock trading account with Bank of America is a straightforward process that involves gathering the required documents, completing an online application, agreeing to the terms and conditions, and funding your account.

Funding your stock trading account

Once you have opened a stock trading account, you'll need to fund it to start investing. Bank of America provides several options for funding your account:

Electronic fund transfers

Electronic fund transfers allow you to transfer money directly from your bank account to your stock trading account. Bank of America provides a secure and convenient online platform for initiating these transfers. You can link your bank account to your stock trading account and transfer funds with just a few clicks.

Wire transfers

If you prefer a faster method of funding, you can use wire transfers. Wire transfers allow you to send money electronically from your bank account to your stock trading account. Bank of America provides the necessary instructions and details for initiating a wire transfer. However, it's important to note that wire transfers may incur additional fees.

Check deposits

If you prefer a more traditional method, you can fund your stock trading account by depositing a check. Bank of America allows you to deposit checks through their mobile app or at a local branch. Simply endorse the check and follow the instructions provided by the bank to complete the deposit.

Minimum deposit requirements

Bank of America's stock trading account may have minimum deposit requirements. These requirements vary depending on the type of account you choose and your investment goals. Make sure to review the account terms and conditions to determine the minimum deposit amount for your specific account.

Fees and charges

When funding your stock trading account, it's important to be aware of any associated fees or charges. Bank of America may charge fees for certain types of deposits or withdrawals. These fees can vary depending on the funding method you choose and the specific terms of your account. It's advisable to review the fee schedule provided by the bank to understand the costs involved.

Summary: Bank of America provides various funding options for your stock trading account, including electronic fund transfers, wire transfers, and check deposits. It's important to be aware of any associated fees and minimum deposit requirements.

Understanding stock market orders

Before you start placing trades, it's crucial to understand the different types of stock market orders. Stock market orders determine the specific instructions you give to the broker when buying or selling stocks. Here are some common types of stock market orders:

Market orders

A market order is an instruction to buy or sell a stock at the current market price. When you place a market order, the broker will execute the trade as soon as possible at the prevailing market price. Market orders ensure quick execution but do not guarantee a specific price. They are useful when you want to buy or sell a stock promptly without being concerned about the exact price.

Limit orders

A limit order is an instruction to buy or sell a stock at a specific price or better. When placing a limit order, you specify the maximum price you're willing to pay for a stock (when buying) or the minimum price you're willing to accept (when selling). The broker will execute the trade only if the specified price or a better price is available in the market. Limit orders provide more control over the execution price but may take longer to fill, especially if the specified price is not immediately available.

Stop orders

A stop order is an instruction to buy or sell a stock once it reaches a specified price, known as the stop price. Stop orders are commonly used to limit potential losses or protect profits. When the stop price is reached, the stop order becomes a market order, and the trade is executed at the prevailing market price. Stop orders are particularly useful in situations where you want to automate the execution of a trade based on a specific price level.

Summary: Understanding the different types of stock market orders, such as market orders, limit orders, and stop orders, can help you execute trades effectively and maximize your investment potential.

Research and analysis tools

To make informed investment decisions, it's essential to have access to reliable research and analysis tools. Bank of America's stock trading account offers a range of tools to help you analyze stocks, track market trends, and make data-driven choices.

Company profiles and financial data

Bank of America's stock trading account provides comprehensive company profiles and financial data for the stocks you're interested in. Theseprofiles include key information about the company, such as its industry, market capitalization, revenue, and earnings. You can also access financial statements, including balance sheets, income statements, and cash flow statements, to assess the company's financial health and performance over time. This information is crucial in conducting fundamental analysis and evaluating the investment potential of a stock.

Analyst reports and recommendations

Bank of America's stock trading account provides access to analyst reports and recommendations from reputable research firms. These reports offer insights into a company's prospects, industry trends, and potential risks. Analyst recommendations can help you understand the consensus opinion of experts and guide your investment decisions. It's important to consider multiple analyst reports and assess the credibility of the sources to make well-informed choices.

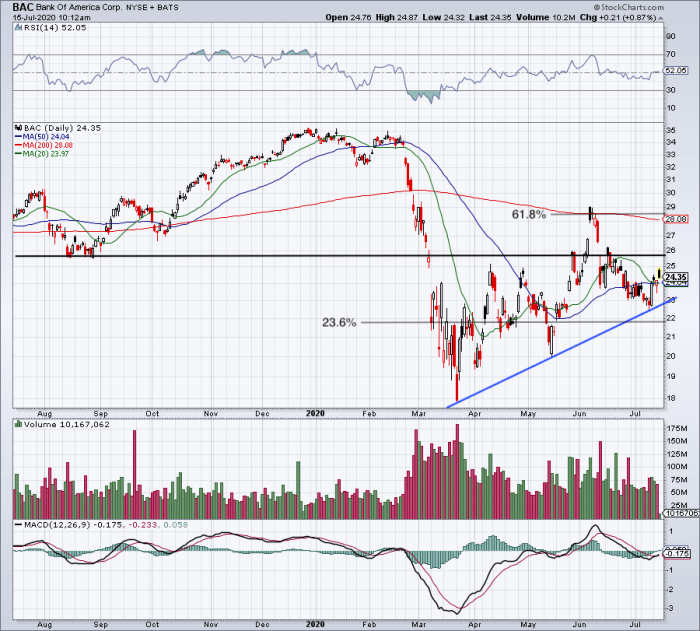

Charting and technical analysis tools

Bank of America's stock trading account offers charting tools and technical analysis indicators to help you analyze stock price patterns and trends. Charts provide visual representations of a stock's historical price movements, allowing you to identify support and resistance levels, trend lines, and other key technical patterns. Technical analysis indicators, such as moving averages and relative strength index (RSI), can help you gauge market sentiment and make predictions about future price movements.

Screeners and watchlists

Bank of America's stock trading account includes screeners and watchlist features that enable you to filter stocks based on specific criteria and create customized lists of securities to monitor. Screeners allow you to define parameters such as price, market capitalization, sector, and other fundamental or technical factors to identify potential investment opportunities. Watchlists help you track the performance of selected stocks, providing real-time updates on price changes, news, and other relevant information.

News and market insights

Bank of America's stock trading account provides access to news articles, market commentary, and economic insights from reputable sources. Staying informed about the latest news and market developments can help you understand the factors influencing stock prices and make informed investment decisions. The account may offer customizable news alerts and economic calendars to ensure you stay up to date with relevant events.

Summary: Bank of America's stock trading account offers a wide range of research and analysis tools, including company profiles, financial data, analyst reports, charting tools, screeners, watchlists, and news updates. These tools enable you to conduct thorough research, perform technical analysis, and stay informed about market trends, empowering you to make well-informed investment decisions.

Building a diversified portfolio

Diversification is a key strategy in minimizing risk and maximizing returns. Bank of America's stock trading account can assist you in building a diversified portfolio by providing access to a wide range of investment options.

Asset allocation

Bank of America's stock trading account allows you to allocate your investments across different asset classes, such as stocks, bonds, mutual funds, and ETFs. Asset allocation involves spreading your investments across different types of assets to reduce the impact of volatility in any single investment. This helps balance risk and potential returns, as different asset classes may perform differently under various market conditions.

Sector diversification

Within the stock market, Bank of America's stock trading account enables you to diversify your portfolio by investing in stocks from various sectors. Different sectors, such as technology, healthcare, finance, and consumer goods, may experience different levels of growth and volatility. By investing in stocks across multiple sectors, you can reduce the risk associated with any single sector's performance and increase the potential for stable long-term returns.

Geographic diversification

Bank of America's stock trading account also allows you to diversify your portfolio geographically. You can invest in stocks of companies based in different countries or regions. Geographic diversification helps reduce the risk associated with any single country's economic or political events. By investing globally, you can tap into opportunities in different markets and benefit from the growth potential of diverse economies.

Summary: Bank of America's stock trading account provides access to a variety of investment options, enabling you to build a diversified portfolio. By allocating your investments across different asset classes, sectors, and geographies, you can reduce risk and increase the potential for long-term returns.

Managing and monitoring your investments

Once you have invested in stocks, it's crucial to actively manage and monitor your investments. Bank of America's stock trading account provides tools and features that enable you to track your portfolio's performance, set alerts, and stay updated with market news.

Portfolio overview

Bank of America's stock trading account offers a portfolio overview that allows you to view all your holdings and their current values in one place. You can track the performance of individual stocks, mutual funds, and ETFs, as well as your overall portfolio. The portfolio overview provides essential information such as gains and losses, asset allocation, and investment performance over time.

Alerts and notifications

Bank of America's stock trading account allows you to set up alerts and notifications for specific stocks or market events. You can customize alerts based on price movements, news updates, or any other criteria that are important to your investment strategy. These alerts can be sent via email, text message, or within the account's dashboard, ensuring that you stay informed about critical developments that may impact your investments.

Market research and news updates

Bank of America's stock trading account provides access to market research reports, news updates, and market commentary. You can find information about the latest market trends, company-specific news, and economic insights. Staying informed about market developments can help you make timely decisions and adjust your investment strategy as needed.

Tracking and analyzing performance

Bank of America's stock trading account offers tools to track and analyze the performance of your investments. You can generate reports and charts that provide insights into your portfolio's historical performance, risk-adjusted returns, and other key metrics. These tools enable you to evaluate the success of your investment strategy and make data-driven decisions to optimize your portfolio.

Summary: Bank of America's stock trading account provides tools and features to help you actively manage and monitor your investments. From portfolio overviews and performance tracking to alerts and market research, these features enable you to stay informed and make informed decisions based on your investment goals and risk tolerance.

Understanding fees and charges

Before investing, it's essential to understand the fees and charges associated with stock trading. Bank of America's stock trading account may have certain fees and charges that you should be aware of:

Commission fees

Bank of America may charge commission fees for executing trades on your behalf. These fees can vary depending on the type of investment, such as stocks, bonds, or mutual funds, and the size of the transaction. It's important to review the fee schedule provided by the bank to understand the commission fees associated with your stock trading account.

Account maintenance fees

Bank of America's stock trading account may have account maintenance fees. These fees are typically charged on a periodic basis, such as monthly or annually, to cover the costs of maintaining your account and providing you with access to the platform's features and services. Review the account terms and conditions to understand the account maintenance fees that may apply to your specific account type.

Additional charges

In addition to commission fees and account maintenance fees, Bank of America's stock trading account may have additional charges for certain services or transactions. These charges can include fees for wire transfers, paper statements, inactivity, or account closure. It's important to review the fee schedule provided by the bank to understand any additional charges that may apply to your account.

Summary: Bank of America's stock trading account may have commission fees, account maintenance fees, and additional charges for specific services or transactions. It's important to review the fee schedule to understand the costs associated with your stock trading account.

Support and customer service

Bank of America's stock trading account offers dedicated support and customer service to assist investors. Here are some of the support options and resources available:

Customer service channels

Bank of America's stock trading account provides customer service through various channels, such as phone, email, and live chat. You can reach out to their support team for assistance with account-related queries, technical issues, or general investment inquiries. The customer service representatives are trained professionals who can provide guidance and support based on your specific needs.

Additional resources

Bank of America's stock trading account offers additional resources to help you navigate the stock market with confidence. These resources can include educational materials, investment guides, webinars, and interactive tools. Accessing these resources can enhance your knowledge and skills, empowering you to make informed investment decisions.

Summary: Bank of America's stock trading account provides customer support through various channels, including phone, email, and live chat. They also offer additional resources to assist investors in understanding the stock market and making informed investment decisions.

In conclusion, Bank of America's stock trading account provides a comprehensive and user-friendly platform for individuals looking to invest in the stock market. With its range of features, educational resources, and personalized support, it caters to both beginner and experienced investors. By opening an account and following the steps outlined in this guide, you can start your journey towards building a successful investment portfolio. Take advantage of the opportunities presented by Bank of America's stock tradingaccount and embark on a rewarding investment journey today.

In summary, Bank of America's stock trading account offers a wealth of features and benefits to investors. With its user-friendly interface, real-time market data, research tools, and personalized support, it provides a comprehensive platform for individuals to engage in stock trading. By opening a stock trading account with Bank of America, you gain access to a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. This allows you to diversify your portfolio and potentially maximize your returns while minimizing risk.

To open a stock trading account with Bank of America, you need to gather the required documents, complete the online application, and agree to the terms and conditions. Once your account is active, you can fund it through electronic fund transfers, wire transfers, or check deposits. It's important to be aware of any associated fees and minimum deposit requirements.

Understanding the different types of stock market orders, such as market orders, limit orders, and stop orders, is crucial for executing trades effectively. Bank of America's stock trading account provides research and analysis tools to help you make informed investment decisions. These tools include company profiles, financial data, analyst reports, charting tools, screeners, watchlists, and news updates.

Building a diversified portfolio is essential for managing risk and maximizing returns. Bank of America's stock trading account allows you to diversify your investments across different asset classes, sectors, and geographies. This helps reduce the impact of volatility in any single investment and increases the potential for stable long-term returns.

Once you have invested in stocks, Bank of America's stock trading account provides tools for actively managing and monitoring your investments. These tools include portfolio overviews, alerts and notifications, market research, and performance tracking. It's important to stay informed about market trends and news updates to make timely decisions and adjust your investment strategy as needed.

Before investing, it's crucial to understand the fees and charges associated with stock trading. Bank of America's stock trading account may include commission fees, account maintenance fees, and additional charges for specific services or transactions. Reviewing the fee schedule provided by the bank ensures that you have a clear understanding of the costs involved.

Bank of America's stock trading account offers dedicated support and customer service through various channels. Their team of professionals can assist you with account-related queries, technical issues, and general investment inquiries. Additionally, they provide educational resources and tools to enhance your knowledge and skills in the stock market.

In conclusion, Bank of America's stock trading account is a comprehensive and user-friendly platform that caters to both beginner and experienced investors. By opening an account and utilizing the features and resources provided, you can embark on a successful investment journey. Whether you're looking to grow your wealth, plan for retirement, or achieve specific financial goals, Bank of America's stock trading account can be a valuable tool in your investment strategy. Start exploring the opportunities presented by the stock market and make informed investment decisions with Bank of America's stock trading account.